Contents:

If you are anything like me, you've spent most of your life trying to avoid the daunting and confusing realm of health insurance. But unfortunately, at some point in our lives, we must learn. Maybe it's your first full-time job, and you're now confronted with choosing a plan, or maybe you've had insurance for years but have never really had to confront it until a surgery or accident. Whatever it may be, you're just now realizing your knowledge of health insurance is not as expansive as you thought. But do not fear; this article will cover all the basics, so you can confidently understand and choose the right plan.

What is health insurance?

Health insurance alone isn't too scary of a concept. Health insurance is a type of insurance that helps you cover your medical expenses, whether that means doctor's appointments, surgery, medication, etc. Even if you don't normally have large medical expenses, health insurance protects you in the worst-case scenario. In the chance of an emergency, insurance is there to help you cover the thousands of dollars these unpredictable medical events could cost you.

There are several important factors of a health insurance plan:

Premium:

Your premium is the amount of money you pay each month for insurance. This is basically the monthly cost of your insurance. It can change year to year, depending on things like inflation and the overall cost of medical supplies in healthcare. However, unlike car insurance, your premium doesn't go up and down based on your health.

Your premium is the cost that employers often contribute to when you receive health insurance through your job. Therefore, a key part of understanding your premium is learning how much you vs. your employer is contributing. In addition, depending on your employer, the price of your premium may change.

Deductible:

Your deductible is the amount you pay for health expenses before your insurance company begins covering costs. For example, your insurer may set your yearly deductible at $1,500, meaning they will only start covering medical expenses once you pay and document $1,500 in out-of-pocket expenses (aka once you've spent $1500 of your own money on items that would otherwise be covered under your plan).

Your copayments, out-of-network provider services, and premiums usually don't count toward your deductible. What counts depends on the insurance plan and which services and medications they typically cover. However, some preventive services such as vaccinations, contraceptives, and several types of disease screenings may be covered before you reach your deductible.

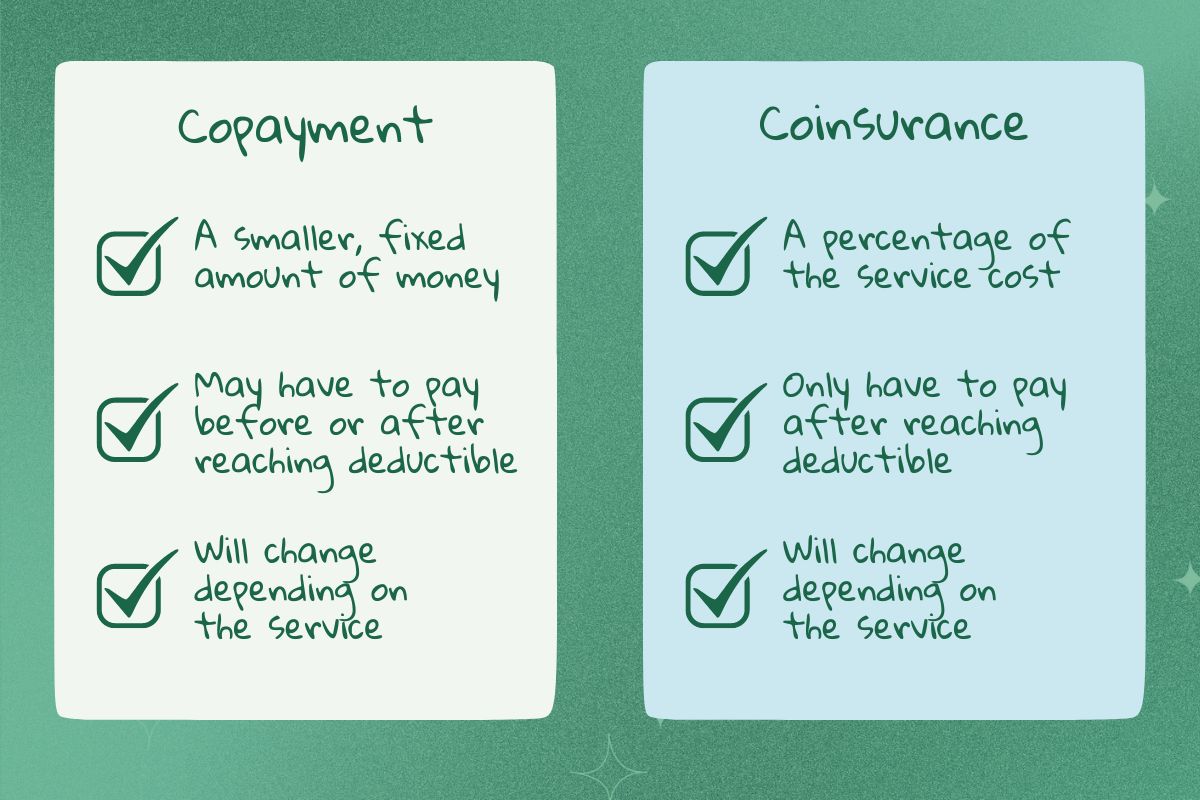

Copayments and Coinsurance:

Even after you've reached your deductible, you often still have to make copayments ("copays"). A copayment is typically a smaller, fixed payment that you make to cover part of a service or prescription. For example, suppose an appointment with your primary care provider typically costs $300 out of pocket. In that case, your copay may be a fixed payment of $50. So, once you've reached your deductible, you would pay $50 per visit instead.

It's important to note that your copay may vary from service to service (i.e., a hospital visit may have a higher copay than a PCP visit). Additionally, some services (preventive services) may be covered before reaching your deductible and may only require a copay. Additionally, plans with higher premiums may not require copays at all.

Coinsurance is similar, except it's the percentage of the cost you cover for a service after you've reached your deductible. Your coinsurance is typically dependent on your plan. For example, if you have a plan where your insurance covers 80% of costs, then your coinsurance is 20%. This means you have to pay 20% of your costs out-of-pocket for most covered services. So, for example, if a service is around $300 and you've already reached your deductible, you will pay 20% ($60) out-of-pocket.

Allowed Amount:

Your allowed amount is the maximum cost your insurance will cover for a service. Typically, if you are going to a provider in your insurance's network (you can find out what providers are covered by contacting your insurance company), your provider and insurer have already agreed on the amount your provider will charge for a certain service regardless of if your deductible has been reached or not.

For example, if your provider usually charges $200 for an appointment, but they have agreed to only charge $150 to people covered by your insurance company (the allowed amount), then you should only be paying $150 for your appointment if you haven't reached your deductible. If you have reached your deductible, you should be paying even less.

It's important to pay attention to your medical bills to ensure you aren't being charged over the allowed amount if you go to a provider in your insurance network. Billing departments can make mistakes, so be aware.

Out-of-Pocket Maximum:

There is, fortunately, a limit to what you pay in deductibles, copays, and coinsurance. This limit is set by your insurance company and is called your out-of-pocket maximum. Once you've reached this limit, insurance covers 100% of covered costs. So, suppose your insurance plan's out-of-pocket maximum is $5,000. In that case, once you've paid $5,000 in deductibles, copays, and coinsurance, your insurance company begins to cover 100% of copays and coinsurance.

Unfortunately, several costs don't count towards your out-of-pocket maximum. These include your monthly premium, out-of-network costs, services not covered by your plan, and costs that exceed your allowed amount.

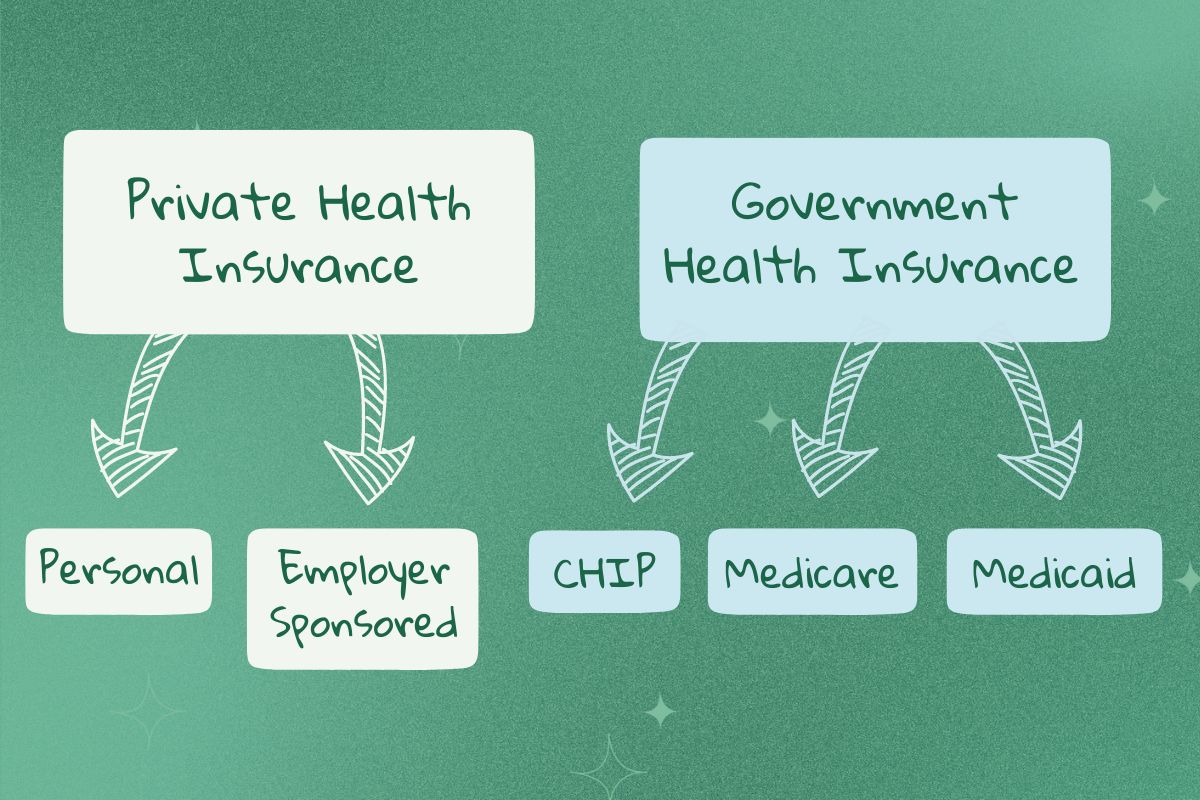

How do I get health insurance?

You can get health insurance in several ways depending on your income, job, age, and more.

Private Health Insurance

Private health insurance is health insurance that a private insurance company like Aetna, Anthem, and Blue Cross provides. Private insurance is often more expensive than government health insurance but offers more flexibility and coverage options. They may also cover more medical services than government health insurance. There are two types of private health insurance.

Employer-Sponsored Health Insurance

Most people's health insurance is offered through their job. Likely, your employer will have a certain plan or plans they offer and will cover some of your health insurance costs (usually, your premium costs). Therefore, it'll be less expensive than personal health insurance. Additionally, this means the percentage you pay for the premium comes from your paycheck pre-tax, saving you money in the long run.

All businesses with over 50 full-time employees are required by law to provide their employees with health insurance. If your job has less than 50 full-time employees, they are not required to provide health insurance, but they still may. Smaller employers can enroll in a program called Small Business Health Options Program (SHOP). SHOP allows small employers to afford to provide health insurance to their employees.

Personal Health Insurance

Another option is to buy your own personal health plan. An individual plan allows you to choose whatever plan you'd like and isn't reliant on your job. However, unless you are eligible for a subsidy from the government, a personal plan will likely be more expensive since you aren't sharing the cost with your employer.

Government Health Insurance

Government health insurance is funded by the government and provided to those who may not have access to or can't afford private health insurance plans. There are several types of government health insurance.

Medicare

Medicare is federal health insurance provided to those 65 years or older, those with disabilities, and those with End-Stage Renal Disease. There are four parts of Medicare, each covering a different service. Part A is hospital insurance and covers hospital stays, nursing facility care, hospice care, and a few other health care services. Part B is medical insurance and covers doctors' services, medical supplies, care outside of hospital stays, and preventive services. Finally, part D helps cover prescription drugs and recommended vaccines. You can enroll in multiple parts, depending on what you need covered.

Lastly, a Part C option is offered through private insurance companies called Medicare Advantage. This option is an alternative plan to Parts A, B, and D that includes additional benefits. That said, it can also be much more restrictive in what they actually cover, so make sure you are doing your research.

Additionally, many people purchase supplemental plans that offer more generous coverage than what just Medicare covers. You can shop for these supplemental plans via the Marketplace. Again, it's important to do extensive research when choosing an insurance plan.

Medicaid

Medicaid is a federal government and state-funded insurance program for older adults, pregnant women, and those with lower income, children, or disabilities. Each state offers its own Medicaid plan with different eligibility requirements and plan/coverage options.

CHIP

Children's Health Insurance Program (CHIP) is a government and state-funded insurance program that provides insurance to children from low-income households who may not qualify for Medicaid. This type of insurance is offered through Medicaid or other CHIP programs and administered by each state.

What to Consider When Choosing a Plan

Coverage of Current Expenses

Before choosing a plan, evaluating your current healthcare costs is important. For example, if you already have a dedicated team of medical or mental health providers, you should choose a plan that includes those providers in their network. Paying attention to what plan covers your current providers may reduce the number of plans you must choose from. This is the same for any medications you might be taking. Consider the costs of your medications under each plan. Ensuring the important things you already rely on are covered can save you money.

The Plan’s Cost-Sharing

Cost-sharing is the share of costs you cover out-of-pocket for covered medical expenses. These charges include your copay, coinsurance, and deductible. There's an inverse relationship between the costs you have to cover and the cost of your monthly premium. Usually, health insurance plans with low coinsurance, low copayments, and low deductibles have higher premiums and vice versa. Though it may be tempting to pick plans with cheaper premiums, if you usually have a decent amount of healthcare costs, plans with more expensive premiums may save you more money in the long run.

High-Deductible Health Plans (Low Premium Plans)

A high-deductible health plan (HDHP), sometimes called a bronze plan, typically means your cost-sharing charges will be higher, but your premium will be less expensive. As of 2023, an individual plan must have a deductible of over $1500 to be considered an HDHP.

Because you have a higher coinsurance and deductible, you will pay more healthcare costs if you need more care. Therefore, this plan is probably best for someone who typically doesn't have many healthcare costs but still wants to be insured for the worst-case scenario.

Additionally, with an HDHP, you are eligible for a Health Savings Account (HSA). An HSA is a savings account where you can put money on a pre-taxed basis aside for health care expenses. Much like a 401K, this money doesn't get taxed and may earn interest, but it can only be used for deductibles, copays, etc. These funds also roll over from year to year and remain with you permanently, even if you change jobs or retire. If your employer doesn't offer this or you have personal insurance, you may still be able to open an HSA and should check with your insurance company.

High Premium Plans

Plans with mid-level cost-sharing charges and premiums may be best if you get routine care but don't typically have high healthcare costs. These plans are often called silver plans.

Plans with low cost-sharing charges and high premiums are best for someone who typically has a lot of healthcare costs and will likely save you money. These plans may be called gold or platinum plans.

Similar to an HSA, plans with lower deductibles and more coverage (silver, gold, and platinum plans) may offer a Flexible Spending Account (FSA). Unlike HSAs, FSAs are only offered through employers. An FSA is like an HSA in the sense that you set aside pre-taxed money into a savings account that can't be taxed, but it does not roll over from year to year.

The Plan Type

Another aspect of health insurance is the plan type. There are four types of insurance plans that range in rigidity: an HMO, PPO, POS, or EPO plan. Certain plans give you flexibility when choosing a provider, while others require providers within their network.

| Plan Type | HMO | EPO | POS | PPO |

|---|---|---|---|---|

| Can Go Out-of-Network | No | No | Yes | Yes |

| Must Have a PCP | Yes | No | Yes | No |

| Need a Referral to See a Specialist | Yes | No | Yes | No |

Health Maintenance Organization (HMO)

With an HMO, you are required to choose doctors, hospitals, mental health professionals, and more from a list of covered providers (except during emergencies). You must also have a primary care provider. If you need to see a specialist, you must first visit your PCP for a referral to a specialist in-network, which will add time to the process. That said, an HMO plan is also less complicated than others because your PCP is coordinating most of your care.

Plans with lower premiums are more likely to be HMO plans because they tend to be less flexible and, therefore, less expensive. Still, if you have complicated medical problems, see a wide range of specialists, or travel quite a bit, there may be better plans for you.

Exclusive Provider Organization (EPO)

An EPO is like an HMO because you can only visit providers within your network (except in emergencies). That said, you don't need a referral to see a specialist if that specialist is in-network, saving you time. In addition, an EPO often has a lower premium than POS and PPO plans.

Point of Service (POS)

A POS plan is like a combination of an HMO and a PPO plan. Like a PPO, you can see doctors outside your network, though they may cost more than doctors in your network. However, like an HMO, you must first receive a referral from your primary care provider to see a specialist. A POS plan may be more expensive than HMOs and EPOs because of the added flexibility.

Preferred Provider Organization (PPO)

A PPO plan is generally more expensive because you can see providers outside your insurance's network. That means PPOs are likely to be higher premium plans. If you plan on seeing a provider out-of-network, it may cost more depending on your insurer's allowed amount. Additionally, a PPO does not require you to have a PCP or get a referral before seeing a specialist.

Conclusion

After reading more about health insurance and all that goes into this complicated concept, it's important to start thinking about your healthcare needs.

Here are some more things to consider when choosing a plan:

- Are you someone that goes to the doctor regularly?

- Are you someone struggling with a chronic illness who may frequently be going to specialists?

- Do you have prescription medications that you'd like covered?

- Are you older or more at risk for health complications?

- How much are you able to spend in the worst-case scenario?

These questions can help you decide what plan is best for you, whether you want a higher premium or deductible, what plans you could be eligible for, and more. As frustrating as health insurance can seem, it's quite important. It can save you thousands of dollars if something goes wrong. However, everyone's medical needs are different, so it's up to you to determine what is best for you.